Connect with us

Published

9 months agoon

Rob Shelton | Lehi Free Press

For many taxpayers, municipal financial reports might seem like impenetrable walls of numbers and accounting jargon. However, these documents reveal a critical story about how effectively a city manages public dollars and plans for the future.

Lehi City’s 2024 Annual Comprehensive Financial Report offers taxpayers a window into the stewardship of their contributions — revealing both impressive financial management practices and areas where improvements could further strengthen the city’s fiscal foundation.

At 159 pages of detailed financial statements, notes and statistical data, the comprehensive report can be challenging for citizens to digest. This summary aims to highlight the key findings and management strategies in a more accessible format.

As the city continues its dramatic transformation from a small agricultural community to a tech-driven economic powerhouse, understanding these complex financial structures becomes increasingly important for residents and businesses alike.

Five financial strengths

1. Strong revenue growth

The financial report reveals impressive revenue growth across multiple sources. Lehi has achieved a 77.3% increase in tax revenue from 2015 to 2024, with sales tax revenues specifically growing by 165.2% during this period. This growth reflects the city’s success in developing a robust commercial base, particularly within the thriving Silicon Slopes tech corridor.

The city’s total governmental fund revenues increased from $69.1 million in 2019 to $86.4 million in 2024, providing essential resources to support the community’s expanding needs.

2. Prudent “rainy day” fund

Lehi maintains a notably strong general fund balance of $33.9 million, with $25 million classified as unassigned (the city’s rainy day fund). This represents 41.7% of total general fund expenditures, exceeding recommended best practices for municipal finances and providing exceptional financial flexibility.

This strong reserve position gives the city significant capacity to respond to unforeseen challenges while maintaining service levels.

3. Solid debt service coverage

The city has established solid debt service coverage ratios within its utility enterprise funds. Water revenue bonds show a coverage ratio of 6.41, electric revenue bonds at 6.06, and drainage revenue bonds at 9.75 — all significantly exceeding the required 1.25 ratio.

These figures indicate efficient operations and healthy revenue streams supporting existing debt obligations, positioning the city well for future infrastructure investments.

4. Effective capital planning

Lehi’s approach to capital planning stands out as particularly effective. The city implements comprehensive five- and ten-year capital plans for infrastructure needs, allowing for strategic debt issuance for high-impact projects like the new fire station, city hall and Family Park.

The city’s legal debt margin remains completely untapped, providing significant capacity for future needs as the community continues to grow.

5. Diverse revenue base

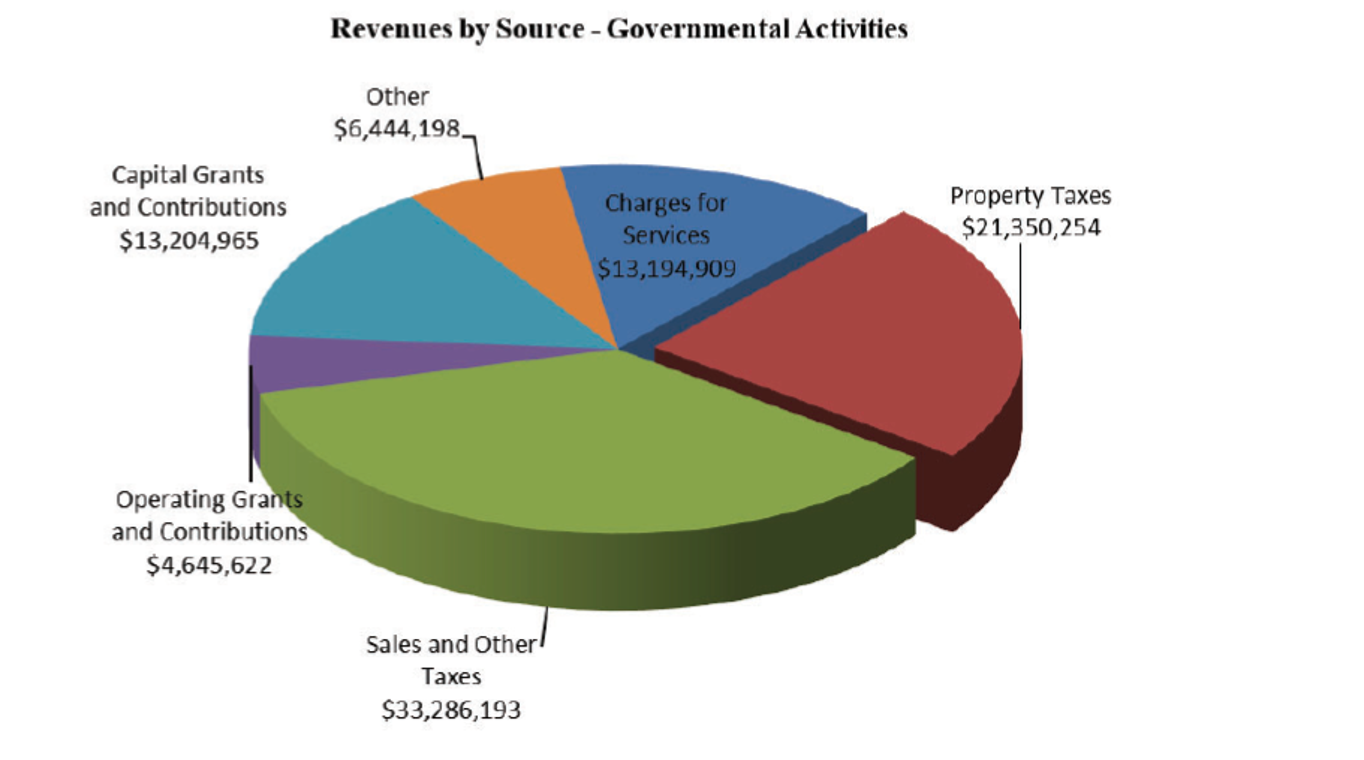

Another key strength is Lehi’s diversified revenue base. The city has established multiple sustainable revenue streams beyond property taxes, including sales taxes; Parks, Arts, Recreation, and Culture (PARC) tax; utility charges; franchise fees and impact fees.

This diversification helps insulate the city from economic fluctuations in any single sector, creating a more stable financial foundation.

Four areas for improvement

1. Managing growth-related expenses

The city’s expenditures have grown substantially, with governmental fund expenses increasing from $60.8 million in 2019 to $102.9 million in 2024.

While much of this increase reflects planned capital investments rather than operational cost increases, Finance Director Dean Lundell provides context: “2024 is a bit of an anomaly for total expenditures. Included in the $102 million is $32.9 million in expenditures for things like Family Park, City Hall/Library, and Fire Station #84. These are not annual expenditures, but rather one-time costs.”

Nevertheless, the rate of growth in operational expenses, particularly in public safety, requires careful monitoring to ensure long-term sustainability.

When asked about impacts of potential inflation with tariffs on construction goods such as steel, Lundell responded, “We are currently about 40% billed on construction costs for the new civic center. For the remaining 60% still at risk, we are actively tracking material price trends and securing purchases early to mitigate potential price increases. While this doesn’t eliminate cost risks, it significantly reduces exposure to market volatility.”

2. Enterprise fund performance challenges

The city’s fiber-optic network currently shows a deficit net position of $3.1 million, though this was anticipated during the construction phase.

“The construction of the city’s fiber network will be completed by late summer/early fall of 2025,” Lundell notes. “After completion, we anticipate a period of 3-5 years until we reach full market saturation. Current projections anticipate a self-sustaining operation as early as FY2030.”

The electric fund also faced challenges in 2023 due to market price fluctuations, prompting implementation of a power purchase adjustment clause. The city has since taken steps to address this vulnerability.

“The city has taken numerous steps to insulate itself from the market fluctuations that led to significant losses in FY2023,” Lundell says. “Lehi’s future portfolio now has greater fixed-rate resources, compared to previous years, which will make the utility less impacted by market fluctuations.”

He adds, “These measures and positive markets have allowed Lehi Power in FY2024 to recover over 90% of the losses that occurred in FY2023.”

3. Deposit insurance coverage gap

The city’s financial report reveals that $8.78 million in bank deposits are “exposed to custodial credit risk as uninsured and uncollateralized.” This means that a substantial portion of the city’s cash holdings exceeds FDIC insurance limits and lacks alternative collateralization.

Lundell addresses this concern: “The city’s funds are invested in a variety of financial instruments. The vast majority is invested with the Utah State Investment Pool managed by the State Treasurer. This investment pool has its cash invested in a variety of securities.”

He continues, “While these funds are not FDIC insured, the large size and great diversity make losses extremely unlikely. The city also has funds invested in local banks located in the city. While the majority of these funds are also not FDIC insured, we feel confident in the health and strength of these local institutions. We continuously evaluate the safety of investments with return, and prioritize security over return.”

Lundell also mentioned that the city is currently investigating collateralization agreements with the banks that would securitize these deposits so that funds above the FDIC level would be secured.

4. Public safety investments

Public safety expenditures have increased by 71% since 2019, raising questions about long-term sustainability.

Lundell identifies the driving factors: “The main factors driving public safety expenditures is 1) wages and 2) staffing and equipping Fire Station #84. Recruiting and retaining police officers and firefighters has become significantly more difficult in recent years.”

He adds that much of the increase in recent years relates to the new fire station: “Staffing and equipping Station #84 is a one-time bump up in costs and won’t continue to disproportionately impact public safety budgets.”

As Lehi continues its remarkable growth trajectory, its financial management practices reflect a balance of prudent fiscal stewardship and forward-thinking investment. While challenges remain in managing the costs of growth, addressing enterprise fund performance and mitigating deposit insurance exposure, the city’s strong financial foundation provides a solid platform for addressing these issues while continuing to deliver high-quality municipal services.