Education

ASD approves 1.7% net property tax increase despite pushback

Published

4 months agoon

Rob Shelton | Lehi Free Press

The Alpine School District Board voted 5-2 on Tuesday, August 5, to raise property taxes, approving a net increase that will cost the median homeowner an additional $28 annually, despite overwhelming public opposition.

Board members Sarah Beeson and Emily Peterson cast the dissenting votes after nearly two hours of heated public comment, with residents voicing frustration over rising costs and questioning the district’s fiscal management. The approved measure raises the capital levy by four increments while reducing the debt service levy by three, resulting in a net increase of one increment, or about 1.76% over the certified tax rate.

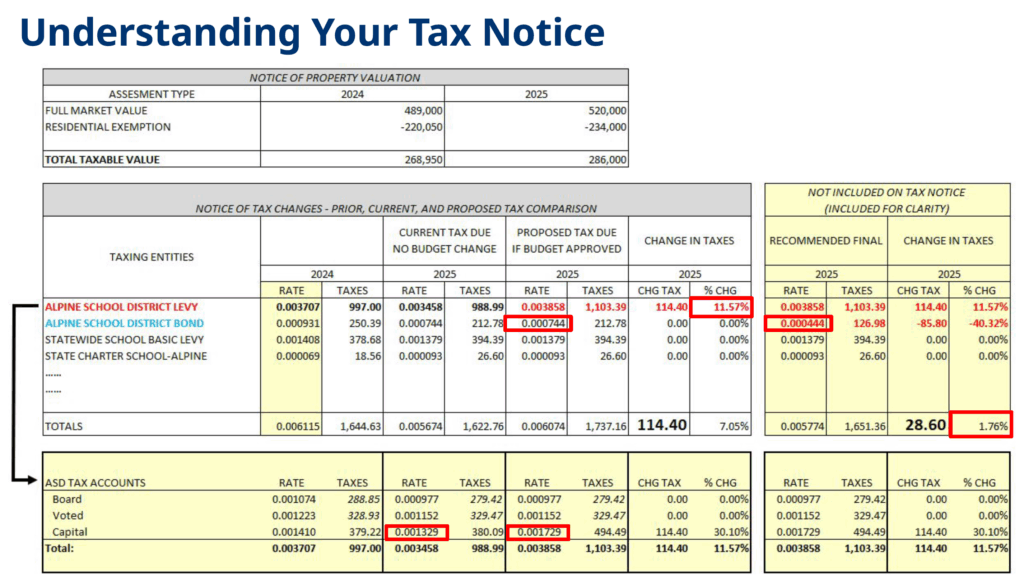

According to the district’s presentation, the median home value in Alpine School District (ASD) is $520,000. The net one-increment increase translates to $28.60 annually or $2.38 per month for that median-valued home.

“We have the opportunity now to do something that gives each new school board a strong starting position, instead of them needing to raise taxes sharply in two years,” said Board Vice President Stacy Bateman.

The tax adjustment comes as ASD prepares to split into three separate districts in 2027 — a voter-approved change that many at the meeting said was meant to bring more local control and fiscal responsibility.

Pattern fuels frustration

According to the district’s presentation, Alpine’s tax rate has decreased 25% over the past nine years due to rapid growth and rising property values. The rate dropped from 0.007718 in 2017 to the current 0.005674 certified rate.

But residents mentioned that their actual tax bills have increased dramatically due to soaring home values.

“You’ve raised taxes 64% in five or six years with only 11% student growth,” said John Barrick, who warned board members they’d face accountability at the ballot box. “The Utah Taxpayers Association recommends you have truth in taxation once every five to seven years, and you’ve asked for it seven times in the last eight years.”

“This is your opportunity to earn back trust,” Barrick told board members. “Last year, Sarah Hacken lost her board seat after voting for six consecutive tax increases. It wasn’t a coincidence. It was accountability.”

Sharp divide emerges

During public comments, nearly all speakers opposed the increase. Several pointed out that their property taxes have risen 70-80% over the past seven years while their incomes remained relatively flat.

“I’m on a fixed income, and I have to decide between medications and food,” said Jennifer Osborne, a Lehi resident who works in healthcare. “Now you keep increasing taxes so people just can’t afford it.”

Brandon Wallace, who moved to Utah County in 2017, said his property taxes have increased 76% since then. “In the last four years, it’s been 62% of that 76% increase,” he said. “I don’t think your income has increased 76% in the last seven years. I know mine hasn’t.”

Brent Gray, speaking virtually from Vineyard, didn’t mince words: “Every time we say no to a bond, you just raise our taxes. Every time we say no to raising taxes, you do it anyway.”

Not everyone opposed the increase. Guy Fugal, Pleasant Grove’s mayor, who is running for a seat on the Timpanogos School District Board (one of the three new districts from the split), spoke in favor of the tax increase. Speaking as a resident and business owner, Fugal thanked the board “for looking forward.”

“A lot of us didn’t have the opportunity to vote on a three-way split that we’re facing here now,” Fugal said. “You’re going to help us immensely in the new districts to lessen the impact that will have on future tax increases.”

Jonathan Bejarano also urged the board to consider the bigger picture. He argued that decreased state income tax funding has forced districts to rely more heavily on property taxes. “If we kept the 5% income tax rate, we could reduce property taxes by 17%,” he said.

Leah Collings, an Orem mother of eight, stood in the minority among other in-person speakers supporting the increase. After researching and comparing Utah County’s tax rates to different areas of the country where her friends live, she found Utah’s rates significantly lower.

“I just looked on taxfoundation.org at some of the states that my friends live in to see what their county tax rates are and what ours is,” Collings said. “Ours is 0.46% and some of theirs are as high as 2.5%, and their schools show.” She added, “I feel like I pay too little in property taxes. We are a family-centered community, yet we do not invest in education.”

Board maintains state funding requirements

The debate exposed deep divisions among board members about fiscal responsibility and preparing for the district split.

After the meeting, Beeson posted on Facebook that she couldn’t “in good conscience” support any increase, and argued that the district already meets state requirements for funding. “We are already at the 20 increments the state asks districts to maintain to qualify for full guaranteed funding,” she said. “We need to prove we’ve done everything to operate within the means we already have.”

In a letter to the editor the day after the vote, Beeson expanded on her opposition, writing that while she respects the November 2024 vote to split the district, she understood “what many are just now beginning to realize: splitting a district is expensive.”

“Even though the official split doesn’t take effect until July 2027, now is the time to begin operating like three lean, independent districts,” Beeson wrote. “Just like a couple approaching retirement might try living on a smaller budget to test their plan, we should be practicing fiscal restraint today, not two years from now.”

She argued the district needs leaders who will “reassess budget priorities, identify smart cuts, pursue alternative funding streams and, most importantly, honor the trust and voice of taxpayers.”

“Raising taxes shouldn’t be a routine. It should be a last resort,” Beeson wrote, adding that increasing taxes before exhausting other options sets “a precedent that will carry into each of the new districts.”

The district currently sits at about 21 increments in its board and voted levies, just above the 20-increment threshold required to receive full state funding. Due to recent changes in state law, the “hold harmless” provision that protected districts from losing funding dropped from five years to one year, making it crucial to maintain those 20 increments.

Board Vice President Stacy Bateman pushed back, noting the district runs “so lean” that it regularly denies funding requests. “We rarely give what is being asked for,” she said. “We have asked everybody to cut.”

Bateman also emphasized the need to prepare new districts: “We have the opportunity now to do something that gives each new school board a strong starting position, instead of them needing to raise taxes sharply in two years.”

Board member Ada Wilson expressed concerns about funding the new Timpanogos School District (the southern area of the current district). “We have a $22 million deficit,” Wilson said. “If we leave it to a future board, it will be too late. There will not be functioning computer systems, district offices, bus garages, or special education facilities.”

Wilson also signaled a shift away from keeping under-enrolled schools open, acknowledging the financial strain they place on the district. “I know in my area there’s been some kicking the can down the road, as far as addressing what needs to happen, as far as schools with very low enrollments, which are costing us more to keep open and not serving our students,” Wilson said. “I am not the person who is willing to do that anymore. We’re not going to be kicking the can down the road anymore in the south if I have anything to do with it. We need to cut costs. We must cut costs.”

Joylin Lincoln acknowledged the pain of raising taxes but argued that the net one-increment increase amounts to roughly [the rate of] inflation. “It’s a balance,” she said. “Otherwise, we have to say ‘no, no, no’ when they come asking for buses, when they ask to keep buildings open.”

Money matters explained

Business Administrator Jason Sundberg spent 45 minutes breaking down the complex tax structure, explaining that while the district requested authority to raise the capital levy by four increments (generating about $22.8 million annually), it simultaneously planned to reduce the debt service levy by three increments (about $17.1 million) using existing fund balances to cover debt payments.

The maneuver provides flexibility for the new districts and allows cash payments for construction rather than using bonding as a funding tool. Sundberg noted that on a $35 million elementary school, financing over 17-18 years would add $12-15 million in interest costs.

Utah County tax notices show the larger four-increment increase without reflecting the debt service reduction, displaying an 11.57% increase that created confusion and anger among residents. The actual net impact is a 1.76% increase. Board member Ada Wilson acknowledged the misleading nature of the county notices, saying “it’s deceptive” and explaining that state laws and county requirements prevent showing decreases on the notice.

“We’ve been working with our county officials to make it more opaque and more indicative of what we’re really asking, but it gets kind of governed by some state laws,” Wilson said. “By its nature, it is only a notice of tax increases. It doesn’t have a way of showing the decreases.”

Looking ahead

Several speakers questioned why the current board was making decisions affecting future districts. “Let the new school boards do their job when they’re elected,” Barrick said.

The approved increase takes effect for the 2025-26 fiscal year. Board elections in November will determine who leads the new districts when they officially separate on July 1, 2027. As a result of propositions passed last November, ASD will be replaced by three new districts.

In her letter, Beeson urged voters to ask tough questions about future board candidates: “Are we choosing leaders who can innovate, or just replicate? Will they protect our schools without sacrificing our stability? Will they say, ‘We can do better—not by doing more, but by doing smarter’?”

Beeson concluded: “The future of our schools—and our taxpayers—depends on who steps up next.”

Fugal warned residents about the split’s financial reality, pointing out that many voters expected lower taxes from dividing the district. “Those people who voted for the splits didn’t realize that… what a misconception,” he said, emphasizing what he believes will occur, that creating three districts will increase costs, not reduce them.

You may like

-

UCHD confirms new measles case in Utah County

-

Barriers near 2100 West cause confusion for Lehi residents

-

Lehi to host national hoops showcase

-

Pioneer boys begin with tough schedule

-

Falcon boys make promising start

-

Falcon girls start 3-1 in hoops

-

Lehi, Skyridge runners cap season at Brooks West Regionals

-

Pioneer girls win hoops tourney title

-

Lehi City to host its first-ever community Chanukah Celebration

-

Lehi Real Estate Snapshot: November 2025