Connect with us

Published

1 year agoon

The Alpine School District (ASD) Board of Education meeting was packed on Tuesday evening, with residents offering their position on the district’s proposed property tax increase.

The approved change raised the certified tax rate from .005715 to .00615, a four-increment increase. The district also had three increments of debt service drop-off but added those three increments back to the board levy. The property tax increase will result in an increase of approximately $108 annually or $9 a month for homeowners at the district’s median home value of $489,000.

During Tuesday’s meeting, District Business Administrator Jason Sundberg presented to the public what the additional tax revenue is planned to be allocated to, including:

● Operational investment in full-time employees for class size reduction, paraprofessional support, substitute teacher pay increase and teacher mentor programs

● Inflation in building costs

● New facilities and technology

The planned allocation includes the much-anticipated new Saratoga Springs High School to serve Saratoga Springs and Eagle Mountain. $67 million over the next three years would be used from this tax increment increase, while the board anticipates doing a lease revenue bond for the remaining $86 million later this year. If approved, the high school would break ground in June 2025 and be ready for the 2028-29 school year.

As is customary for Truth-in-Taxation hearings, taxpayers filled the room to express their thoughts, with overwhelming opposition and some support sprinkled in.

“Over the past four years, the district has gone from just under $11,000 per student to over $13,000 per student with this proposed budget. A 19% increase per student across the whole district. I would encourage you to vote against this increase,” said American Fork resident Jared Johnson to kick off public comment from more than 30 individuals.

“I love Alpine School District, and I’ve supported most of the increases in the past, but this is a hard one. I want to see where the sacrifices are coming from. We’re all sacrificing with utilities and home costs… Looking at salaries, the median income for Utah is $71,000. You look at Alpine School District, and person after person is making over $200,000. There need to be cuts,” said Orem resident Lisa Winegar.

“I’ve lived in this school district in the same home for 50 years and paid for my grandchildren and now great-grandchildren. I’m opposing Alpine School District’s tax increase. I’m on a fixed income, and we pay more and more and more each year… I’m speaking for all of those on a fixed income, and this is a hardship. Maybe the next generation can take this on,” said Carey Kerr of Pleasant Grove.

While the overall theme of public comment was opposition to the increase, there were several proponents and supporters of the increase who spoke before the board members.

“I wish we had more state legislators here to see the consequences of cutting state income tax. When the state cuts income tax, the local districts must make up the difference with higher property tax. I support the property tax increase because schools are our most valuable investment,” said Saratoga Springs resident Carly Ferrin.

“I stand here today in strong support of this tax increase. I’ve lived in the Alpine School District my entire life. I’ve gone through the schools, and it was a phenomenal experience. I love education, and I know a strong education sets up our youth for success later in their lives. Our school district needs increased funding,” said Alex Day of American Fork, who also echoed Ferrin’s criticism of reducing the state income tax earlier this year by state legislators.

Public comment concluded, and Board President Sara Hacken of Orem brought the discussion back up to the board for a motion. Pleasant Grove board member Mark Clement motioned to approve the proposed tax increase and was rained down on with shouting and displeasure from the crowd. Members of the public got up to leave the meeting, and several shouted at the board, “You never listen,” while exiting.

“These meetings are really difficult to be at. I appreciate those that have taken the time to advocate… I hear what you’re saying, and I understand what you’re saying. So please, when you go away from this meeting and don’t feel you weren’t heard, I heard; I just had to take a different perspective,” said Saratoga Springs board member Joylin Lincoln in her closing remarks.

“We do listen, and we do hear. We heard, but the hard part about this is sometimes people that are elected officials get voted in, and they get accused of not listening, and what I think that means to some people is that ‘You don’t agree with the way that I think’… You may not be happy with my vote tonight, but you know what: you can vote me out. That’s America,” said American Fork board member Sarah Beeson.

“It’s really hard to continually hear teachers be attacked and for our administrators to be attacked. As far as cutting, our principals are literally looking at things all year round. Business Services is looking at things all year round. I know all of you don’t see the budget process. I wish you would come out when we go through that. The number of requests far exceeds what we’re able to fund… I also don’t think we build Taj Mahals. We build schools to house our kids and last 50 years,” said Lehi board member Stacey Bateman in response to public comment regarding administrator salaries and school building costs.

The tax increase comes amidst a potential district split in the upcoming November General Election. The new tax revenues, as well as new upcoming debt, will be divided and allocated by the taxable value of each new district if the split is approved by voters.

Local child protection group takes its fight against big tech to the FTC

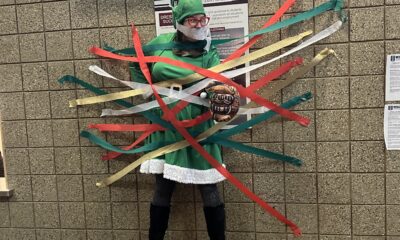

Willowcreek administrators spark holiday cheer for students

Teen entrepreneurs showcase innovation at Christmas market

Why a new mineral find near Utah Lake is drawing national attention

Aspen Peaks School Board approves budget, launches staff searches and boundary study

Lehi’s TSSD sewer rates to increase over 100% by 2027

Lehi Free Press

Falcon boys take 2nd in hoops tourney

Lehi hosts largest Chanukah celebration in Utah County history

Falcon girls hoops goes 1-2 in tight stretch