Politics & Government

Controversial affordable housing concept gets a negative recommendation from the planning commission

Published

1 year agoon

Matt Hemmert | Lehi Free Press

On December 5, Lehi City returned a unique development code update to the Planning Commission after the commission tabled it in August due to its complexity and the need for further study to make an informed recommendation to the City Council. This time around, the city rebranded the concept from Critical Homeownership Overlay Zone (“CHOZ”) to Attainable Homeownership Overlay Zone (“AHOZ”) and included a change to a concerning component, but the commission was still skeptical.

In 1973, Horst Rittel and Melvin M. Webber described a social planning paradox they named “a wicked problem.” City Planner Brittney Harris began the commission hearing by explaining that Lehi’s affordable and attainable housing issue was just that: a wicked problem.

A wicked problem is an issue that is nearly impossible to solve because it’s difficult to define, is complex, has interdependencies and is multicausal, presents no clear single solution, will have unforeseen consequences with any solution, any solution requires multiple stakeholders, and any solution requires changing social behavior and attitudes.

Brittany Harris was again joined by Lehi resident Jason Harris(no relation to Brittany Harris). Given his long career in residential development, Jason Harris has been heavily involved with Lehi’s concept development over the past 13 months. Thiscollaboration has included city staff, multiple city departments, city council members, and real estate developers. Jason Harris has also presented the concept to banking institutions and mortgage companies. While Lehi is the first city to progress this far with this concept, Jason Harris stated he has also been working with Harrisville City, Eagle Mountain, Lindon, and Weber County.

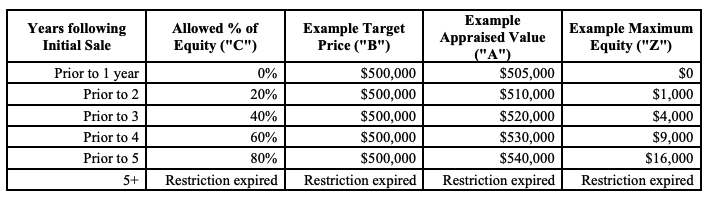

Last week’s proposal was not vastly different from the Augustproposal. In August, the city proposed the CriticalHomeownership Overlay Zone, which would allow a developer to apply for the overlay designation and ask for higher densityfor a residential project in return for locking home prices at approximately 20 percent lower than current market rates. The principle driving this approach would be economic land efficiency, wherein a developer’s cost to acquire land decreaseswith the increased density if the overlay is granted. On the converse, the city claimed purchasing the land after a zone change for the same increased density would increase the cost of land. A development agreement would spell out the details if the City Council approves the overlay. Additionally, the concept offered homes to specific types of buyers for 30 days prior to opening sales to the general public, required owner occupation(no rentals), and would lock equity return according to a 10-year allowed equity schedule. The purpose of the equity lock is to ensure that a buyer doesn’t take advantage of the artificially low price and immediately resell it at market pricing.

Last week, it was clear that the most recent version of the proposal did not address the Planning Commission’s initial concerns expressed in August or in subsequent work sessions. The only material change was made to the controversial lock on homeowner equity return. In the August proposal, equity was locked pursuant to a 10-year schedule. This was changed to a five-year schedule in the current proposal.

Commissioner Brent Everett voiced a concern that the code stated pricing would use comparable home pricing, or “comps”looking back 12 months and within a one-mile radius. He asked how comps in that radius could be reasonably applied given they are in an area where those homes are subject to full market value. He continued by asking whether the city should and could use a more tailored and different scope related to comps rather than utilizing standard home buying comp methodology for a non-standard and reduced house pricing model.

Speaking to the equity lock and schedule concept, Everett said that the proposal doesn’t make certain requirements “has to be” for developers. “But we’re making this a ‘has to be’ on the equity earned by those [homeowners] in the first [10] years. So,you just shifted the [financial] balance to someone else,” Everett continued.

“The game we play in development is the city wants infrastructure and developers wants density. All negotiations come down to how much density a developer can get for the infrastructure the city wants,” Commissioner Emily Lockhart said. “If developers can get [higher] density now and they’re not passing that savings on to consumers now, why are the CEOs and the development community not doing this now? Why do you need an overlay to force you [into a paradigm] to pass on savings when we’re already in negotiations for density, you already get it, and you’re keeping the [margin] spread?”

Lockhart was also concerned about comps used to determine pricing, but from a different perspective. She asked about the impact on surrounding homes’ market value if homes in the proposed overlay, with artificially low valuation based on the selling price, were used as comps?

Commissioner Tyson Eyer, Commissioner Nicole Kunze, and Commission Chair Greg Jackson all expressed concern about the need to create a housing authority to oversee long-term compliance with development agreements as well as deed restrictions.

Jackson expressed that the entire proposal hinges on one thing: it is contingent on a landowner not knowing the true value of their land at the time of sale to a developer. “We’re really asking the average citizen to shoulder any loss here,” Jackson said.

“The housing crisis is really important to me and something a lot of my friends are struggling through,” Lockhart said. “As someone in the age range that has come through a lot of these economic hardships in this country on a macro level and also here in Utah, I get it. I’m a young single mom trying to make it work in life. What I have before me does not address my concerns.”

In speaking to the draft code amendment, Jackson listed specific concerns he’d have to see addressed. He said that a 20 percent decrease in home cost perhaps isn’t meaningful enough to make a difference for those the code is designed to assist. He also said that there needs to be very tight definitions of “critical worker” and “Lehi resident” and suggested both require a minimum of one year of employment or residency. A third concern was that the 30-day window offering a home to specific segments of homebuyers prior to opening it up to the general public was too short.

Public comment was overwhelmingly supportive of the proposal.

Of note, Strong Towns Lehi, represented by Leah Jay, said that allowing more residential density will lower housing prices and is essential for Lehi’s financial success. Additionally, Kenzie Stirling, a senior at Skyridge High School, said this plan is a step in the right direction.

The Planning Commission sent a negative recommendation to the City Council given the code amendment has too many problems with ambiguity in drafting and lack of details. Additionally, the commission listed the negative impacts on current homeowners, overcrowding of schools, strain on infrastructure, and the need for more affected stakeholders to be involved in drafting this type of proposal.

Housing affordability and attainability is a wicked problem indeed.

You may like

-

Teen entrepreneurs showcase innovation at Christmas market

-

Why a new mineral find near Utah Lake is drawing national attention

-

Aspen Peaks School Board approves budget, launches staff searches and boundary study

-

Lehi’s TSSD sewer rates to increase over 100% by 2027

-

Lehi Free Press

-

Falcon boys take 2nd in hoops tourney

-

Lehi hosts largest Chanukah celebration in Utah County history

-

Falcon girls hoops goes 1-2 in tight stretch

-

Pioneer girls drop three to tough teams in hoops

-

Give a piece of Lehi from the Lehi Historical Society gift shop